SaaS

Benchmarks

Report by High Alpha

Overview

This year marks the ninth annual SaaS Benchmarks Report — and the first year of the AI-powered SaaS Benchmarks Calculator! Like last year, the 2025 report draws from the largest dataset in its history. We’re deeply grateful to every founder, CEO, and SaaS leader who contributed, and to the 40+ venture and platform partners who helped make it possible. Our goal remains simple: to make this report an indispensable resource for the entire SaaS ecosystem.

Building with AI is no longer a differentiator — it’s the baseline. Every company founded in 2025 reported AI as core to its product, underscoring that intelligence is now infrastructure. The new edge lies in execution: teams that operationalize AI to amplify productivity, precision, and performance. In the 2024 Benchmarks Report, we introduced the moniker Generation AI. In 2025, we’ve coined the term Operation AI — highlighting the shift in focus from invention to impact.

Finally, while we continue to report on the metrics that define successful SaaS companies, we’re equally focused on the human side of building breakout companies. This year’s survey expands on founder insights, team structure, and company culture, because building early-stage startups is a craft (both art and science), and understanding both is essential to building enduring companies in an AI-powered world.

Let's get into the data!

Thank you to our 2025 partners who made this report possible.

- Presenting Partner

- Venture & Platform Partners

Operation AI: From Novelty to Necessity

As you might imagine, AI is the plumb line running through this year’s Benchmark Report. The survey responses were clear and confirmatory: AI has officially moved from novelty to necessity. The data reveals a decisive shift from experimentation to operationalization. Founders are no longer asking “Can we build with AI?” but “How do we scale, measure, and monetize it?”

Operation AI is a clarion call for founders to professionalize what began as exploration, to systematize AI in the product, integrate it into core workflows, and build organizations that treat intelligence (both human and machine) as a managed, compounding asset. This is the operational era of AI, where the winners will not be those who experiment most creatively, but those who execute most effectively.

The Five Pillars of Operation AI

Make AI Core, Not Cosmetic

Companies with AI at the core of their products are growing materially faster (even when they carry modestly lower gross margins due to compute costs). Stand-alone AI features are a bridge, not a destination. Build end-to-end, AI-native workflows where the value is unmistakable.

Monetize the Outcome

Pricing models are catching up to adoption. The leaders are experimenting with hybrid, consumption, and outcome-based models that align price with realized value — and they’re growing faster (with better retention) as a result.

Expansion Is the Engine

Beyond roughly $20 million in ARR, expansion becomes the dominant growth engine. Use AI to drive multi-product adoption, proactive success, and precision upsell — then pair it with efficient acquisition and short CAC payback to sustain momentum and resilience.

Shift from Pilots to Playbooks

Early-stage teams report deeper internal AI adoption than their more mature peers, yet most still measure impact qualitatively. Move beyond pilots – standardize AI-assisted processes across sales, support, success, and engineering, and tie them to clear KPIs so productivity gains translate directly into Rule of 40 performance.

Rewire for Leverage

ARR per employee climbs sharply with scale as teams get leaner and automation rises. Use AI to compress non-differentiated work, redeploy headcount toward customer impact, and protect margin while you grow. Efficiency isn’t a constraint; it’s the compounding engine of durable growth.

The AI-Driven Market Rebound

The 2024 SaaS Benchmarks Report signaled that the market was entering a phase of stability and modest expansion. This year, we're calling it a full comeback.

Driving the resurgence, especially over the last four quarters, is AI. Venture activity has stabilized at pre-reset levels, but the composition of that capital looks different — fewer rounds, larger checks, and a heavy concentration in AI. For SaaS founders, this signals a more selective market that rewards efficient growth and clear differentiation.

Overall deal value has returned to the highs of 2021.

Although deal value has increased, deal count remains consistent with numbers from 2023 and 2022.

AI continues to dominate venture capital activity, accounting for a disproportionate share of total deal value over the past year.

Average deal sizes now exceed $40 million, illustrating the scale of conviction behind AI infrastructure, enablement, and application layers. This influx has lifted overall venture volumes. But beneath the surface, non-AI sectors are seeing flatter activity, underscoring how AI has become both the growth engine and gravitational center of venture markets.

Growth + AI

Growth favors AI-first products, experiences, and experimental pricing models. The majority of SaaS companies building in 2025 deeply integrate AI into the core of their products and grow faster than their peers in similar ARR bands.

For companies founded before the mass adoption of AI, there remains a challenge: how to build new, AI-native product lines that can compete with modern entrants without disrupting the core product they spent years creating.

The future isn't about bolting on features, but rather architectural reinvention. The question is no longer if you will adopt AI, but how fast you can rebuild your product and business model to survive the shift.

- AI Product IncorporationProduct

- AI Growth RatesGrowth

- AI PricingPricing

SaaS Metrics + Trends

As growth rates and retention metrics hold steady across medians and ARR bands, we're entering a "steady-state growth era." Efficiency metrics like ARR per employee continue to improve as well, as teams learn to do more with less.

Regarding go-to-market, "events" ranked the highest across all ARR bands as the most effective channel. In the age of AI, meeting other humans, face to face, is priceless.

Founder Insights

Founders are facing a dual challenge in aggressively integrating AI while navigating foundational business trade-offs in growth and efficiency. While Go-to-Market execution remains the top concern, the rising priority of AI strategy confirms its long-term importance. Crucially, this AI urgency is ahead of maturity, as over one-third of companies still lack formal measurement frameworks, highlighting the immediate need to move from feature adoption to quantifying real business ROI.

Measurement of Internal AI Impact Still Qualitative

AI adoption among teams is increasing, but measurement maturity is lagging. Over one third of companies rely on informal team feedback, while only a small minority (under 25%) use KPIs or dashboards to quantify impact. This indicates an early phase of operational learning, where companies are investing in AI but lack consistent frameworks to track productivity, efficiency, or ROI.

Engineering Tops the List of AI-Driven Headcount Reductions

Engineering headcount reductions due to AI are significantly higher than any other department. Back office functions like Finance, HR, and IT have been less impacted by reductions at this point.

Early AI products focused on coding, customer support, and content generation likely contribute significantly to driving headcount reductions in the top three functional areas: engineering, customer success & support, and marketing.

Fundraising Success Rates Remain Strong

Fundraising outcomes were surprisingly strong among respondents with three quarters of founders reporting that they raised their target amount or more.

Time to raise for the vast majority of respondents was between one and six months while a significant portion of founders spoke with fewer than fifty investors.

It wasn’t easy for everyone as 6% of founders spent an extraordinary amount of time on the fundraising trail, meeting with more than 100 investors. The effort paid off as 100% of those founders were able to raise capital.

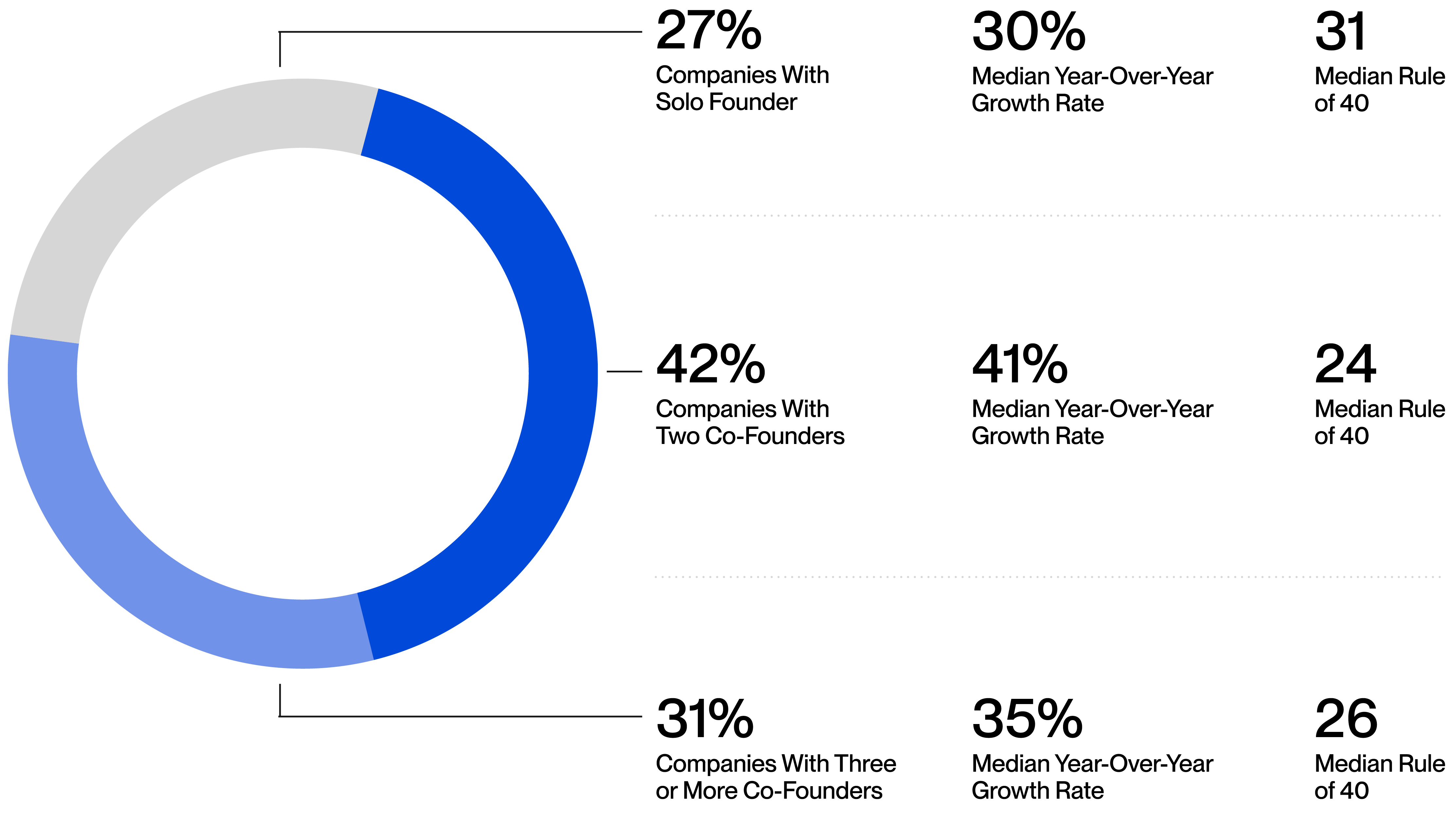

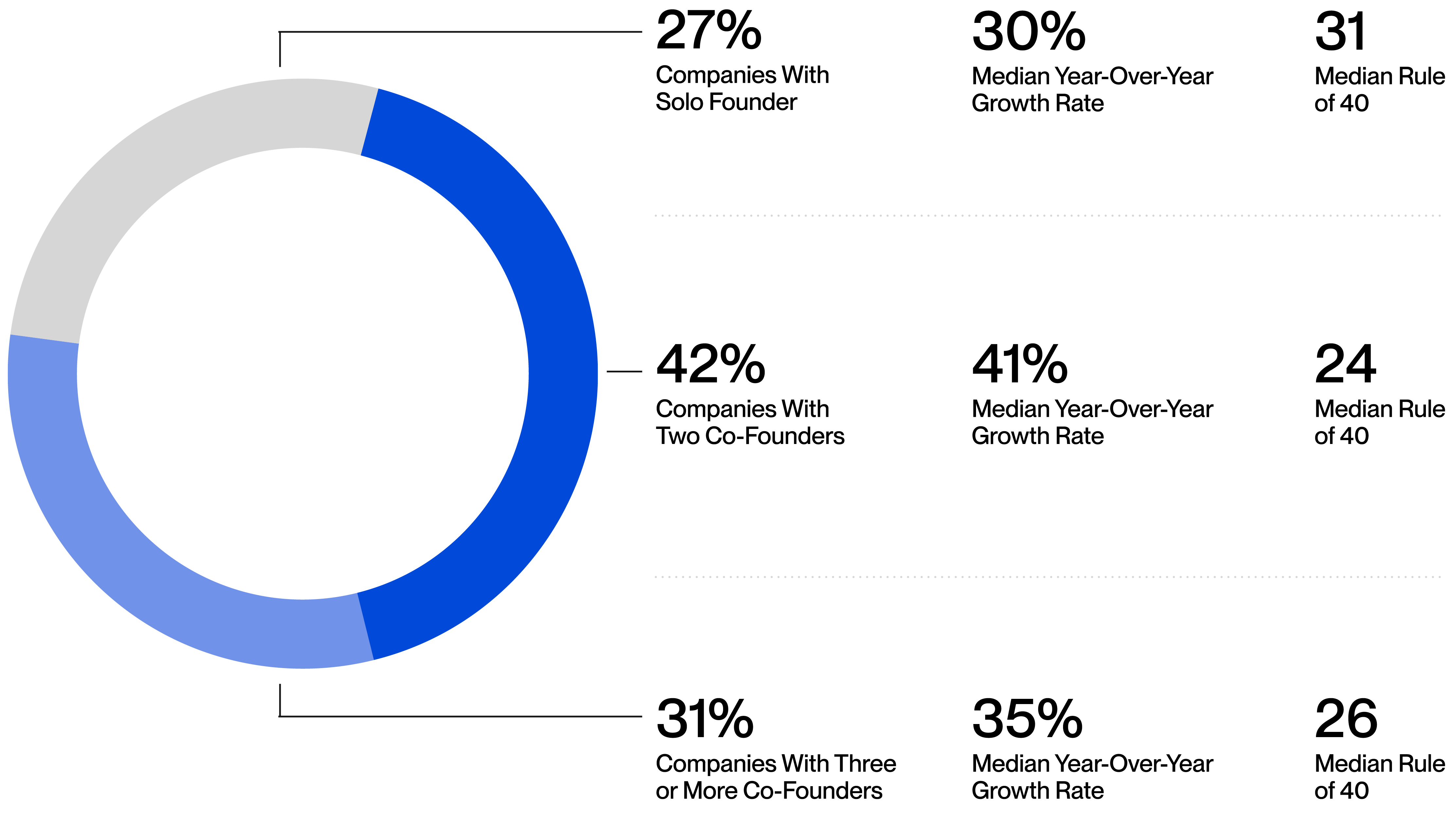

Companies with Two Co-Founders Growing Fastest

Nearly three quarters of respondents had multiple co-founders.

While companies with two co-founders grow the fastest and solo founders lead on efficiency, companies with three or more founders exhibited a balanced mix of growth and efficiency.

Final Thoughts

The 2025 SaaS Benchmarks Report shows that while challenges persist, the SaaS industry is demonstrating remarkable resilience. Like founders, we’re optimistic. The market has evolved, and the new competitive landscape is defined by the profound impact of AI.

The winners in this new environment are companies moving from experimentation to practice, embedding AI into their entire organization. They’re whole-heartedly embracing Operation AI. From the products they’re building to company-wide adoption of AI, the goal now is to focus on effective execution, measurement, and monetization.

We are entering what is likely to be the golden age of AI-enabled SaaS companies, poised to fundamentally re-invent how software is built, sold, and delivered for years to come.

Benchmarks Team

Kristian AndersenCo-Founder & Partner, High Alpha

Kristian AndersenCo-Founder & Partner, High Alpha Scott DorseyCo-Founder and Managing Partner, High Alpha

Scott DorseyCo-Founder and Managing Partner, High Alpha Blake KoriathPartner and CFO, High Alpha

Blake KoriathPartner and CFO, High Alpha Jon HubarttVP, Design & Product, High Alpha

Jon HubarttVP, Design & Product, High Alpha Mollie KuramotoDirector of Marketing, High Alpha

Mollie KuramotoDirector of Marketing, High Alpha Claire KelleyDesign Lead, High Alpha

Claire KelleyDesign Lead, High Alpha

Download the Report